2025 Overall Top Travel Rewards Card

2025 Top Hybrid Travel Rewards Card

2025 #3 Cash Back Card

Let me start off that, yes, there was a lot of buzz about the launch of the American Express Cobalt Card way back in 2017 and that buzz surrounds it to this day. The card has now been around for seven years and it continues to dominate the Canadian market as the best travel rewards and second best (or even the best) cash back card in Canada.

The review of the American Express Cobalt Card is broken down into the following sections:

Overview

The American Express Cobalt Card was the first card in Canada to offer up to a 5% return that wasn't limited to the first few months of having the card. The card provides a 1-2 punch with great earn rates on spending combined with the most valuable and flexible reward options of any credt card program in Canada. This is a card that everyone in Canada should have in their wallet.

Costs & Sign up Features

The American Express Cobalt Card has a $12.99 monthly fee which equates to an annual fee of $155.88. That fee works out to be slightly higher than the $120 to $150 a year we see on competing cards but it is so worth it. You should also know that additional cards come at no cost so there is a savings there in adding authorized users versus many of the competitors.

The standard American Express Cobalt Card welcome bonus provides up to 15,000 Membership Rewards points. In your first year as a new Cobalt Cardmember, you can earn 1,250 Membership Rewards® points for each monthly billing period in which you spend $750 in net purchases on your Card.

This means you need to spend $9,000 in the first year (12x$750) to earn the complete bonus of 15,000 points. If you miss spending $750 in any of those first 12 months you will miss out on the bonus for that month, so it is key you keep on top of your spending to make sure you hit $750 per month for those first 12 months.

The interest rate on the card is 21.99% on purchases and 21.99% on cash advances. Like all American Express card there are no minimum annual income requirements set out for the card

Earning

The card earns Membership Rewards points like other proprietary American Express cards and has category multipliers on the types of purchases:

- 5 Points per dollar spent at eligible restaurants, bars, grocery stores and food delivery in Canada

- 3 Points per dollar spent on select streaming services purchases

- 2 Points per dollar spent on eligible transit & gas purchases in Canada (it no longer earns 2x points on travel as of October 8, 2024)

- Earn 1 additional point on eligible hotel and car rental bookings via American Express Travel Online

- 1 Points per dollar spent on all other eligible purchases

To see where you can earn these multipliers be sure to check out our American Express Cobalt™ Card Confirmed Multiplier Locations which lists hundreds of Canada retailers from around the world where you can earn 5x, 3x, 2x and 1x points as well as locations outside of Canada where you can earn 1x points.

Point Valuation Chart

| Spending Category | Points earned per dollar spent | Rate of return when booking your own travel | Rate of return Cash Back | Rate of return when booking Amex's Fixed Points for Travel | Rate of return when converting to airline & hotel programs |

|---|---|---|---|---|---|

| Restaurants, bars, grocery stores and food delivery | 5 | 5% | 5% | up to 10% | 5% to 30% or higher |

| Select streaming services | 3 | 3% | 3% | up to 6% | 3% to 18% or higher |

| Transit, Gas, American Express Travel Online Purchases | 2 | 2% | 2% | up to 4% | 2% to 12% or higher |

| All other spending | 1 | 1% | 1% | up to 2% | 1% to 6% or higher |

Redeeming

The American Express Cobalt Card participates in Amex's Membership Rewards program which is the best credit card reward program in Canada as it has so many valuable redemption options.

- You can redeem points for any travel you book with the card

- You can redeem points for any purchase you make on the card

- You can redeem via Amex's Fixed Points for Travel

- You can convert your points to Air Canada Aeroplan, Air France KLM Flying Blue, British Airways Executive Club, Marriott Bonvoy and numerous other programs.

If you redeem using the Use Points for Purchases option, you will get a $10 credit towards every 1,000 points redeemed for a purchase. This means the purchases you make on food and drinks will equate to a 5% return, straming services is 3%, transit, gas & rides is 2% and all other spending is 1%. There aren't many cash back cards that can match this cash back option of the Cobalt Card!

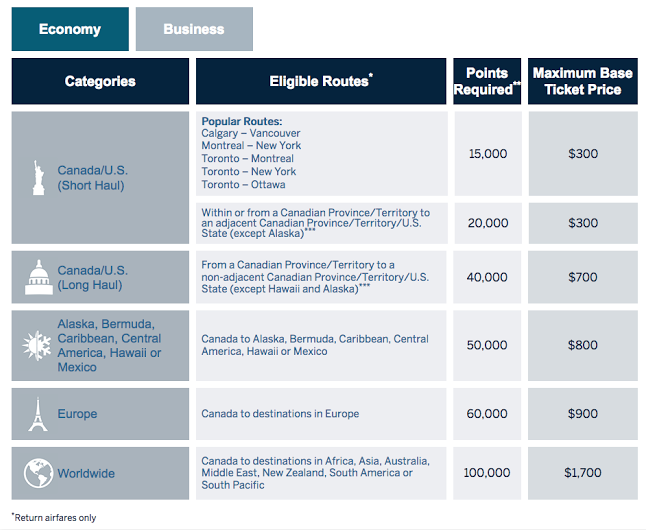

Moving on to the Fixed Points Travel Program, the card provides great value here as well. Being able to earn up to 5 points per dollar means you can be flying for as little as $3,000 in spending on this card and provides up to a 10% return on those food and drink purchases. Here are the Fixed Points award charts:

From the above you'll see you only need 15,000 points for popular short haul round trip flights. Make that spending with 5x multipliers and you have that ticket for only $3,000. You will not achieve that with any other card in Canada. Even business class to Europe is an amazing deal, only $28,000 in spending at 5x points gets you that round trip flight to Europe. Compare this to nearly double that for most other cards in Canada that allow you to redeem for business class. The Fixed Points Travel Program has proven to be a large success for American Express and is most valuable when combined with the Cobalt Card.

Finally, another huge and I mean huge benefit to the redemption side of this card is the ability to convert to Membership Rewards Frequent Traveller participants. As of August 16, 2021 the Cobalt Card gained access to all of American Express' transfer partners including Air Canada Aeroplan and British Airways Executive Club. This is on top of the hotel transfer partners that the card already had. With minimum point values of 1 cent for Marriott, 1.5 cents for Aeroplan and British Airways you are looking at returns of 7.5% for that 5x points earning. But that's a minimum - there are so many occasions where you can get 3, 4 or even more cents per points with this programs that puts the Cobalt's return easily into double digits!

More recently Air France KLM Flying Blue, which is also a Membership Rewards transfer partner updated their redemption rate for economy class flights out of Canada to Europe, Turkey and North Africa to start at 25,000 miles one way and for business class to start at 60,000 miles. That means you can get one of those economy class tickets for only $5,000 in spending ($10,000 round trip) or business class tickets for $12,000 ($24,000 round trip) with the Cobalt Card. This is simply unmatched by any other credit card-frequent flyer program combination!

Current Membership Rewards Transfer partners and the transfer ratio:

- Air Canada Aeroplan - 1 to 1

- Air France KLM Flying Blue - 1 to 0.75

- British Airways Executive Club - 1 to 1

- Cathay Pacific Asia Miles - 1 to 0.75

- Delta SkyMiles - 1 to 0.75

- Etihad Airways Guest - 1 to 0.75

- Hilton Honors - 1 to 1

- Marriott Bonvoy - 1 to 1.2

Features and Benefits

Amex ExperiencesTM

As with all American Express Cards the card comes with Amex ExperiencesTM which includes Front Of The Line® Advance Access, Front Of The Line® Reserved Tickets, Front Of The Line® E-Updates, Special Offers & Experiences for all Cardmembers and Social Access for all Cardmembers.

Amex offers

As with all American Express Cards the American Express Cobalt Card receives Amex Offers. These exclusive limited time offers sent out to cardmembers to receive statement credits or bonus points for using their card at select merchants.

Depending on your shopping habits these offers alone can provide enough savings in a year to cover the annual fee on the card if not more! You can learn more about this feature in Rewards Canada's Guide to American Express Canada 'Amex Offers'

The Hotel Collection

The American Express Cobalt Card provides special benefits when you stay 2 or more consecutive nights at participating properties with The Hotel Collection from American Express Travel

Insurance

The card comes with a pretty strong insurance package that includes:

- Common Carrier Travel Accident Insurance: Up to $250,000

- Flight Delay Insurance: 4 hours $500 in total

- Delayed Baggage Insurance: 6 hours $500 in total

- Lost / Stolen Baggage Insurance: $500 in total

- Damaged Baggage Insurance: $500 in total

- Emergency Medical Insurance (Out of province/country): 15 days up to age 64

- Car Rental Theft and Damage Insurance: 48 Days up to C$85,000 MSRP

- Hotel/Motel Burglary Insurance: Up to $500

- Purchase Protection: 90 days

- Extended Warranty: Up to 1 extra year

- Mobile Device Insurance: Up to $1,000

What is good about this card

The full time earn rate of five points per dollar spend on food and drink is absolutely to die for. This translates to a minimum 5% return for travel or cash back. No card provides that sort of return on both of those types of redemptions.

With the direct conversion in place to Aeroplan the Cobalt Card is the number one Aeroplan point earning card in Canada. Don't want to take our word for it? Just check out feature Which credit card earns the most Aeroplan Points? to see for yourself.

All of the flexible redemption options are great! Amex's Membership Rewards ranks as the Best Travel Rewards Points Currency in Canada thanks to its flexibilty and value and the Cobalt Card earns the most Membership Rewards points!

What is not so good about this card

As many of you know American Express has lower acceptance than Visa or Mastercard so there will be occasions where you cannot use this card to pay for items. Depending on where you live or travel, American Express does state that they are accepted at roughly between 80 and 90% of locations that take the other two brands of cards.

Having the higher points earn rates limited to Canadian purchases. This card use to award them outside of Canada which made it a strong card for food and drink purchases abroad despite charging a foreign transaction fee but that is no longer the case.

Lastly, some people may not like that the card does not have any Trip Interruption or Trip Cancellation insurance. Plus its out of province emergency medical coverage is good for only 15 days where as other premium cards are as high as 31 days or more.

Who should get this card

- Every person in Canada who is eligible to get a credit card should get this card.

- Consumers who buy a lot of food and drinks

- Consumers who take transit, taxis, rideshares on a regular basis

- Consumer who want to make sure they are getting the highest possible return on select category spending

- Consumers who want to earn the most possible Air Canada Aeroplan Points, British Airways Executive Club Avios, Air France KLM Flying Blue Miles and points and miles with other airline and hotel programs

Conclusion

Ever since the Cobalt Card was introduced other cards in Canada have been inching their way up to offering higher standard category bonuses however this card still takes top spot no matter what the competition has done. American Express did their research and made a card that is great for all Canadians.

Amex has taken what they already do so well, rewards, and made them even better with this card. The combination of great earning potential, awesome redemption options and a decent insurance package make this card an all around winner.

Many of our rankings, ultimate wallets and more all feature this card simply because it is the best. When it was released it was about time a Canadian card issuer had the balls to make a card with such strong earning potential and not having it as a limited time option, rather something to reward you with all the time.

If you don't have an Amex card in your wallet or even if you do, this is one you should strongly consider adding. I did. My wife did. Our kids have supplementary cards under my wife's account, I mean the additional cards are free so why not? I know many others have done the same as well. Five points per dollar on the utmost necessity of Food and Drink combined with the best redemption options and value? It's a no brainer.

Latest card details:

American Express Cobalt® Card

Top Overall Travel Rewards Card 2025 | Top Hybrid Travel Rewards Card 2025 | #3 Best Cash Back Card in Canada

In your first year as a new Cobalt Cardmember, you can earn 1,250 Membership Rewards® points for each monthly billing period in which you spend $750 in net purchases on your Card. This could add up to 15,000 points in a year. That’s up to $150 towards a weekend getaway or concert tickets

Monthly Fee $12.99/month of Cardmembership ($155.88 annually) | Additional Cards: $0 | Annual interest rate 21.99% on purchases and 21.99% on funds advances

- Earn 5x the points on eligible eats and drinks in Canada, including groceries and food delivery. Spend cap applies.

- Earn 3x the points on eligible streaming subscriptions in Canada

- Earn 2x the points on eligible ride shares, transit & gas in Canada

- Earn 1 additional point on eligible hotel and car rental bookings via American Express Travel Online

- Earn 1x point for every $1 in Card purchases everywhere else

- Enjoy access to hotel bookings, a room upgrade (when available), 12pm check-in and late check-out (when available), and up to $100 USD hotel credit to use on amenities when charged to the room for a stay of 2 or more consecutive nights through The Hotel Collection from American Express Travel

- Transfer points 1:1 to several frequent flyer and other loyalty programs

- Cobalt Cardmembers receive regular Perks such as bonus reward offers and access to great events

- Access Front Of The Line® Amex Presale & Reserved Tickets to some of your favourite concerts and theatre performances and special offers and events curated for Cardmembers with Amex ExperiencesTM

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment

- Click here to apply for the American Express Cobalt Card

Other cards to consider if you are looking at this card:

- American Express Gold Rewards Card

- BMO Rewards World Elite Mastercard

- BMO eclipse Visa Infinite Card

- mbna Rewards World Elite Mastercard

- RBC Visa Infinite Avion Card

- Scotiabank Gold American Express Card

- Scotiabank Passport Visa Infinite card

- TD First Class Visa Infinite Card

Talk to us!

Tell us what you think of this feature in the comments section below or join the conversation on Facebook and Twitter!

This review was first posted on September 26, 2017 and is updated on regular basis