2024 Top Ultra Premium Card

The Platinum Card from American Express is a card chock-full of benefits, perks and value. It has been in the Canadian market for many years now and is a mainstay in many points and miles enthusiasts wallets as well as astute travellers looking to make their sought after trips and vacations even better!

The review of the Platinum Card from American Express is broken down into the following sections:

Overview

The Platinum Card from American Express is a card targeted towards Canadians who love to travel and want to avail of benefits that can make that travel better. From providing the best airport lounge access benefit out of any card in Canada, hotel elite status benefits, discounts on premium class flights and so much more, this card was developed with travel in mind.

It is due to its long list of benefits along with good points earning and redeeming options that the Platinum Card is the best Ultra Premium card in Canada. That being said you don't have to be a frequent traveller to have this card and in fact many Canadians who only travel once or twice per year have this card as well as it is known for dining benefits and great Amex Offers promotions which don't require you to travel! Then when you do travel you have all those benefits to make use of.

Costs & Sign up Features

The Platinum Card from American Express has an annual fee of $799. This is one of the highest fees in Canada however it is more than made up for with all the benefits the card provides.

For additional cards there are two options. You can add additional Platinum cardmembers for $250 annually and those supplementary cardholders will avail of all the same benefits as the primary cardmember like lounge access, hotel elite status etc. If you don't require that for the additional cardholders you can add an American Express Gold Rewards Card as the additional card with no charge for the first two and $50 per year for any additional cards.

The standard welcome bonus on the card offers 50,000 Membership Rewards Points however the card frequently has limited time increased welcome bonus offers.

Right now the Platinum Card from American Express offering a welcome bonus of up to 100,000 Membership Rewards points. The bonus is awarded as follows:

- New Platinum® Cardmembers, earn 70,000 Welcome Bonus points after you charge $10,000 in net purchases to your Card in your first 3 months of Cardmembership.

- Plus, earn 30,000 points when you make a purchase between 14 and 17 months of Cardmembership.

Earning

The card earns Membership Rewards points like other proprietary American Express cards and has category multipliers on the types of purchases:

- 2 Points per dollar spent on eligible dining and food delivery purchases

- 2 Points per dollar spent on eligible travel purchases

- 1 Points per dollar spent on all other eligible purchases

To see where you can earn these multipliers be sure to check out our American Express Cobalt™ Card Confirmed Multiplier Locations as many of those merchants will be the same for the Platinum Card.

Point Valuation Chart

| Spending Category | Points earned per dollar spent | Rate of return when booking your own travel | Rate of return Cash Back | Rate of return when booking Amex's Fixed Points for Travel | Rate of return when converting to airline & hotel programs |

|---|---|---|---|---|---|

| Dining / Food Delivery | 2 | 2% | 2% | up to 4% | 2% to 12% or higher |

| Travel | 2 | 2% | 2% | up to 4% | 2% to 12% or higher |

| All other spending | 1 | 1% | 1% | up to 2% | 1% to 6% or higher |

Redeeming

The Platinum Card from American Express participates in Amex's Membership Rewards program which is the best credit card reward program in Canada as it has so many valuable redemption options. You can:

- Redeem points for any travel you book with the card

- Redeem points for any purchase you make on the card

- Redeem via Amex's Fixed Points for Travel

- Convert your points to Air Canada Aeroplan, Air France KLM Flying Blue, British Airways Executive Club, Marriott Bonvoy and numerous other programs.

If you redeem using the Use Points for Purchases option, you will get a $10 credit towards every 1,000 points redeemed for a purchase. This means the purchases you make on this card will equate to up to a 2% return.

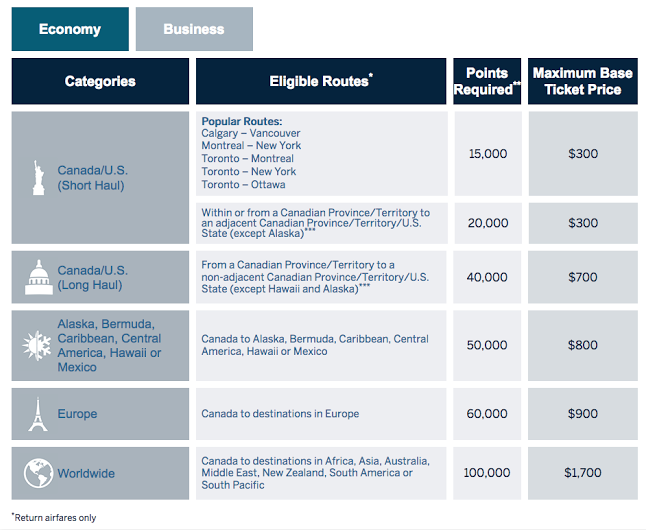

Moving on to the Fixed Points Travel Program, the card provides great value here as well. Being able to earn up to 2 points per dollar means you can be flying for as little as $5,000 in spending on this card and provides up to a 4% return on those dining and food delivery purchases. Here are the Fixed Points award charts:

From the above you'll see you only need 15,000 points for popular short haul round trip flights. Make that spending with 3x multipliers and you have that ticket for only $5,000!

Finally, another huge and I mean huge benefit to the redemption side of this card is the ability to convert to Membership Rewards Frequent Traveller participants. You can transfer the points earned on this card to six airline programs and two hotel programs. With minimum point values of 1 cent for Marriott, 1.5 cents for Aeroplan and British Airways you are looking at returns of 2 to 3% for that 2x points earning on your dining! But that's a minimum - there are so many occasions where you can get 3, 4 or even more cents per points with this programs that puts the Platinum Card's return easily into double digits!

Current Membership Rewards Transfer partners and the transfer ratio:

- Air Canada Aeroplan - 1 to 1

- Air France KLM Flying Blue - 1 to 0.75

- British Airways Executive Club - 1 to 1

- Cathay Pacific Asia Miles - 1 to 0.75

- Delta SkyMiles - 1 to 0.75

- Etihad Airways Guest - 1 to 0.75

- Hilton Honors - 1 to 1

- Marriott Bonvoy - 1 to 1.2

Features and Benefits

American Express Global Lounge Collection

This is the Mack daddy card of lounge access with many different options providing access to over 1,400 business class lounges in over 130 countries around the world. The lounge access benefits for the Platinum Card are as follows

- Executive Lounges by Swissport: Free of charge access for the cardmember + Spouse and 2 children or one guest to participating lounges in Canada. (Benefit applies to both primary and additional Platinum cardmembers)

- Centurion Lounges: Access to American Express Centurion lounges and Centurion Studio lounges for the cardholder and 2 Guests (Benefit applies to both primary and additional Platinum cardmembers)

- Delta SkyClubs: Access to Delta Sky Clubs for no charge for the cardmember who are holding an Delta flight boarding pass. Additional guests must pay an entrance fee. Note: This option is not available if you are flying on the cheapest economy class fare with Delta. (Benefit applies to both primary and additional Platinum cardmembers)

- Additional Global Lounge Collection Partner Lounges: Cardmembers have complimentary access to American Express and Partner Lounge locations (guest access varies by location) Examples of this include select Lufthansa lounges.

- Plaza Premium Lounges: Cardmembers have complimentary access to Plaza Premium Lounges along with one guest (Benefit applies to both primary and additional Platinum cardmembers)

- Priority Pass Lounges: Cardmembers are provided Prestige Membership which provides unlimited lounge access with one guest included per lounge visit. All additional guests are US$32 (Benefit applies to both primary and additional cardmembers)

- Escape lounges: Cardmembers have complimentary access along with 2 Guests (Benefit applies to both primary and additional Platinum cardmembers)

The lounge access is good for not only the primary cardholder but also for additional/supplementary Platinum Cards.

Tip: Use Amex's Lounge search to see which lounges you can access with the Platinum Card.

Annual Travel Credit

Upon approval for the card and then each year on your card's anniversary date you will receive a $200 travel credit that can be used towards any single travel booking of $200 or more charged to Card with American Express Travel Online or through the Platinum Card Travel Service at 1-800-263-1616.

Annual Dining Credit

Basic Platinum Cardmembers now have access to a $200 CAD Annual Dining Credit. Enrolled Cardmembers will be eligible to receive a statement credit of $200 CAD following a single transaction of $200 CAD or more (including taxes and gratuity) at one of the eligible restaurants listed on our website at go.amex/diningcreditrestaurants at the time of the transaction.

The credit is available only once per redemption period. Participating restaurants are subject to change. Spend must be in one transaction. A one-time enrolment is required for the $200 Annual Dining Credit through Amex Offers and Cardmembers will automatically be enrolled for future redemption periods and do not need to re-enroll. Each calendar year is a separate redemption period. In 2023, however, the redemption period will be from September 26, 2023 until December 31, 2023.

Annual Value Credits

Platinum Cardmembers can earn up to $200 or more in additional value with participating partners like Disney+, Holt Renfrew and Lululemon, among others. These will show up in the Amex Offers platform like the current offers but they are and/or will be unique to the Platinum Card.

These are/will be available to all Platinum cardmembers and won't be targeted like many of the general Amex Offers. Amex told me they will "always be committing to at least $200 of value from Member Extras that everyone on the Card will get – it may just be that the merchants change from year to year."

Automatic Hotel and Car Rental Elite Status

The Platinum Card from American Express comes with the following Elite Status benefits:

- Hilton Honors Gold Elite Status

- Marriott Bonvoy Gold Elite Status

- Hertz Gold Plus Rewards Five Star Status

To receive these automatic elite statuses you'll have to log in to your Amex account and register for them. These hotel status levels provide more points on your stays in the respective loyalty programs and depending on which brand you are staying at potential room upgrades, welcome amenities, food & beverage credit and many more benefits. Considering you need to stay in the range 20 to 30 nights to earn status organically with these hotel programs you can see why this can be considered a big benefit!

You can then use that status gained from the Platinum Card to apply for status matches in other programs. We have a complete article on how you can do that:

Recommended reading: How to maximize the elite status benefits from The Platinum Card from American Express

The Hertz status provides 25% bonus points on Hertz rentals, a one car class upgrade and expedited rental service.

Fine Hotels & Resorts + The Hotel Collection

The Fine Hotels & Resorts program provides complimentary benefits at over 1,500 high end properties worldwide when you book via American Express Travel with your Platinum Card. Those benefts include a unique property benefit (typically a food and beverage, spa credit or general hotel credit), daily breakfast for two, guaranteed 4pm late check-out. room upgrade upon arrival when available, In-room Wi-Fi and Noon check-in, when available.

The Hotel Collection from American Express provides up to a $100 USD hotel credit at participating properties and a room upgrade, when available. This is available at over 600 participating hotels and resorts in over 30 countries worldwide, when booking a minimum of two consecutive nights with American Express Travel.

International Airline program

With the Platinum Card from American Express discounts are available on the base fare for qualifying International First, Business, and Premium Economy Class tickets with participating airlines. Those airlines as of July 2022 are as follows:

To receive the discount you have to book with Platinum Travel or online at American Express Travel and pay in full with your American Express Card. Even though IAP states the discount is for Premium Economy and up, when you book with WestJet, you get the discount on any WestJet fare classes except Basic Economy. So if you book Economy 'Econo' fares and up with WestJet you will always save some extra cash by booking via American Express Travel and using your Platinum Card. Read our redemption story below on how we used our Platinum Card to save on our WestJet flights.

Recommended reading: Redemption Stories: Saving $3,800 on last minute flights with the Platinum Card from American Express

Toronto Pearson International Airport Benefits

If you depart from Toronto Pearson International Airport the Platinum Card from American Express provides benefits such as a waived fee for Valet parking, a 15% discount on parking and the major benefit here: access to the Pearson Priority Security Lane in Terminal 1 and Terminal 3 so that you can bypass the long security lines!

Amex ExperiencesTM

As with all American Express Cards the card comes with Amex ExperiencesTM which includes Front Of The Line® Advance Access, Front Of The Line® Reserved Tickets, Front Of The Line® E-Updates, Special Offers & Experiences for all Cardmembers and Social Access for all Cardmembers.

There are also By Invitation Only event packages curated exclusively for Platinum Cardmembers

Amex offers

As with all American Express Cards the Platinum Card from American Express receives Amex Offers. These exclusive limited time offers sent out to cardmembers to receive statement credits or bonus points for using their card at select merchants. Depending on your shopping habits these offers alone can provide enough savings in a year to cover the annual fee on the card if not more! You can learn more about this feature in Rewards Canada's Guide to American Express Canada 'Amex Offers'

NEXUS Statement Credit

One of the more recent additions to the Platinum Card from American Express is a NEXUS Statement credit. You can recaive up to $100 CAD in statement credits every four years when NEXUS application or renewal fees are charged to your Platinum Card.

Insurance

The Platinum card comes with a very strong insurance package that includes the following:

- Out of Province/Country Emergency Medical Insurance - 15 Days up to 64 years old

- Trip Cancellation Insurance - $2,500 per person up to $5,000 maxmimum per account

- Trip Interruption Insurance - $2,500 per person up to $6,000 maxmimum per account

- Flight Delay Insurance - 4 hours $1,000 per person

- Baggage Delay Insurance - 6 hours $1,000 per person

- Lost, Stolen or Damaged Baggage Insurance - up to $1,000

- Car Rental Theft and Damage Insurance - 48 Days up to $85,000 MSRP

- Hotel Burglary Insurance - Up to $1,000

- $500,000 Travel Accident Insurance

- Purchase Protection Plan - 120 Days up to $1,000 per occurrence

- Buyer's Assurance Protection Plan - Up to 1 extra year

What is good about this card

Pretty much everything that was listed above is good about the card!

On the points side, you have earn rates that hold their own against other ultra premium cards and redemption options and value that eclipse those same competitors.

The benefits, we spent a lot of time discussing them above but should point out the most popular and best are the lounge access, the $200 annual travel credit and hotel elite statuses.

The sign up bonus is another strong point, 100,000 points is worth $1,000 towards statement credits and potentially well over that for other travel redemptions.

What is not so good about this card

As many of you know American Express has lower acceptance than Visa or Mastercard so there will be occasions where you cannot use this card to pay for items. Depending on where you live or travel, American Express does state that they are accepted at roughly between 80 and 90% of locations that take the other two brands of cards.

The latest update to the card has seen its earn rate on dining dropped to two points per dollar even though the card is heavily marketed for dining. Two points per dollar isn't terrible per se but there are other cards that can earn much more and if you dine out lots those extra points will be worth more than the limited $200 annual dining credit card seen on this card.

The $799 annual fee is definitely something to consider - it is the highest out of publicly available cards in Canada. If you cannot avail of the benefits this card provides it can be hard to justify that high of fee. Do remember though if you can use that $200 annual credit it basically drops that annual fee to $599, dining credit to $399 and the rest of the benefits easily make up the rest of the annual fee and more if you make use of them.

Even though the card has a strong insurance package some consumers may find the Out of Province Emergency Medical Coverage not as strong as some other cards. The coverage of 15 days to age 64 is standard for American Express however competing there are many premium and ultra premium cards offering coverage up to 31 days or longer for those up to age 64 and even provide a few days coverage for those 65 and over.

Who should get this card

- Consumers looking to elevate their travel experiences

- Consumers who buy premium economy or higher class tickets with the airlines in the International Airline Program

- Consumers who want access to lounges across Canada and around the world and want to bring a guest

- Consumer who buy a lot of travel as the 2 points per dollar earn rate provides a great return on that spending

- Consumers who want the utmost in flexibility when redeeming their points by having great redemption options

Conclusion

This card was developed with travel in mind. When it was revamped quite some time ago American Express had surveyed their existing Platinum cardmembers and overwhelmingly, they were more interested in benefits and perks over points earning. That's not to say this card is bad for points earning, on the contrary it is quite good however if you are not a person who needs all the perks and benefits this card provides you probably should consider the American Express Cobalt Card as that card is a points earning machine!

What you have in the The Platinum Card from American Express is a card that provides a long list of valuable benefits that fits all aspects of luxury travel but you don't have to be a millionaire to have it. Everyday Canadians carry this card to make their travel experiences better as the card does not have a minimum annual income requirement - if you have excellent credit you have a good chance of being able to get this card. So if you like the idea of airport lounge access, potential hotel perks, discounts on premium class travel and more, this is a card for you.

Latest card details:

The Platinum Card®

2025 Top Ultra Premium Credit Card in Canada

Earn up to 100,000 Membership Rewards® points - that’s up to $1,000 towards a weekend away.

Annual Fee: $799 | Additional Card Fee: $250 for Platinum, $0 for Gold (First 2 Cards) then $50 each

- New Platinum® Cardmembers, earn 70,000 Welcome Bonus points after you charge $10,000 in net purchases to your Card in your first 3 months of Cardmembership

- Plus, earn 30,000 points when you make a purchase between 14 and 17 months of Cardmembership

- Earn 2 points for every $1 in Card purchases on eligible dining and food delivery in Canada, 2 points for every $1 in Card purchases on eligible travel, and 1 point for every $1 in all other Card purchases

- Access a $200 Annual Travel Credit through American Express Travel Online or Platinum® Card Travel Service

- Enjoy a $200 Annual Dining Credit at some of Canada’s best restaurants

- Unlock $200 or more in additional value with Member extras. You can earn statement credits for qualifying purchases with participating brands

- Take full advantage of The American Express Global Lounge CollectionTM which unlocks access to over 1,400 airport lounges worldwide. This includes The Centurion® Lounge network, Plaza Premium Lounges, and hundreds of other domestic and international lounges designed to enhance your travel experience

- Enjoy flexible ways to use your points such as statement credits for any eligible purchase charged to your Card, new travel purchases booked on American Express Travel Online through the Flexible Points Travel Program, and eligible flights through the Fixed Points Travel Program

- Transfer points 1:1 to several frequent flyer and other loyalty programs

- Enjoy complimentary benefits that offer an average value of $600 USD at over 1,500 extraordinary properties worldwide when you book Fine Hotels + Resorts

- Platinum Cardmembers can enjoy access to special events and unique opportunities

- Enjoy premium benefits at the Toronto Pearson Airport

- You will also have access to many leading hotel and car rental companies’ loyalty programs. Our partners include Marriott International, Hilton Hotels and Resorts, Hertz and Avis

- Interest applies in accordance with your Cardmember Agreement, Information Box, and Disclosure statement if the total New Balance is not paid by the Payment Due Date each month. All payments must be received by the Payment Due Date shown on the monthly statement

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment

- Click here to apply for The Platinum Card from American Express

Other cards to consider if you are looking at this card:

American Express® Aeroplan®* Reserve Card

American Express® Gold Rewards Card

CIBC Aeroplan Visa Infinite Privilege

Desjardins Odyssey Visa Infinite Privilege

RBC Avion Visa Infinite Privilege

Scotiabank®* Platinum American Express® Card

TD® Aeroplan® Visa Infinite Privilege* Card

Talk to us!

Tell us what you think of this feature in the comments section below or join the conversation on Facebook and Twitter!